All banks face a major problem when it comes to attracting new business — everyone already has a bank. It’s not like a new car that will break down or a smart phone that will inevitably go on the fritz. When they become financially independent, customers select a bank based on proximity, service offerings, word-of-mouth recommendations (typically if their parents banked there, they bank there), or a dozen other reasons. But, after selecting that bank, they tend to stick with it. Which makes your bank marketing all the more difficult.

Everybody already has a bank. And for the most part, those banks look and act the same as you do. So how do you get customers to switch? We’ll start off by admitting we don’t have the silver bullet answer. But we do know how to work through it: by thinking out of the box. And today, we’re not just thinking outside of the box. We’re thinking outside of the industry.

Which brings us to T-Mobile.

Wireless carriers experience a similar issue to banks. Today, everyone has a phone, which means everyone has a phone plan. What makes a phone user want to switch carriers? Obviously, being connected to the retail industry, wireless carriers can play the pricing game to get ahead of the competition, but that game can only be played for so long before being inevitably beaten (think about the competition between Walmart and Amazon).

Back in 2013, T-Mobile launched its long-lived “Uncarrier” campaign, attracting new customers away from the other Big Four carriers (Sprint, AT&T and Verizon). As part of the campaign, they created the Simple Choice plan, offering unlimited everything but without an annual service contract — bringing simplicity and straightforward pricing to an often complicated system. They also introduced JUMP!, a trade-in option for customers to easily and affordably upgrade their phones.

In 2014, T-Mobile also introduced Test Drive, allowing current customers and non-customers to request a free trial kit with an iPhone, a temporary phone number and seven days with the Simple Choice plan — all with unlimited talk, text and high speed data. This allowed potential customers the opportunity to try a new carrier without the commitment. And then in 2015, T-Mobile introduced the Un-Contract. When a new customer signs an “Un-contract,” the plan is guaranteed not to change and the price won’t go up.

So, in a nutshell, T-Mobile broke all the rules.

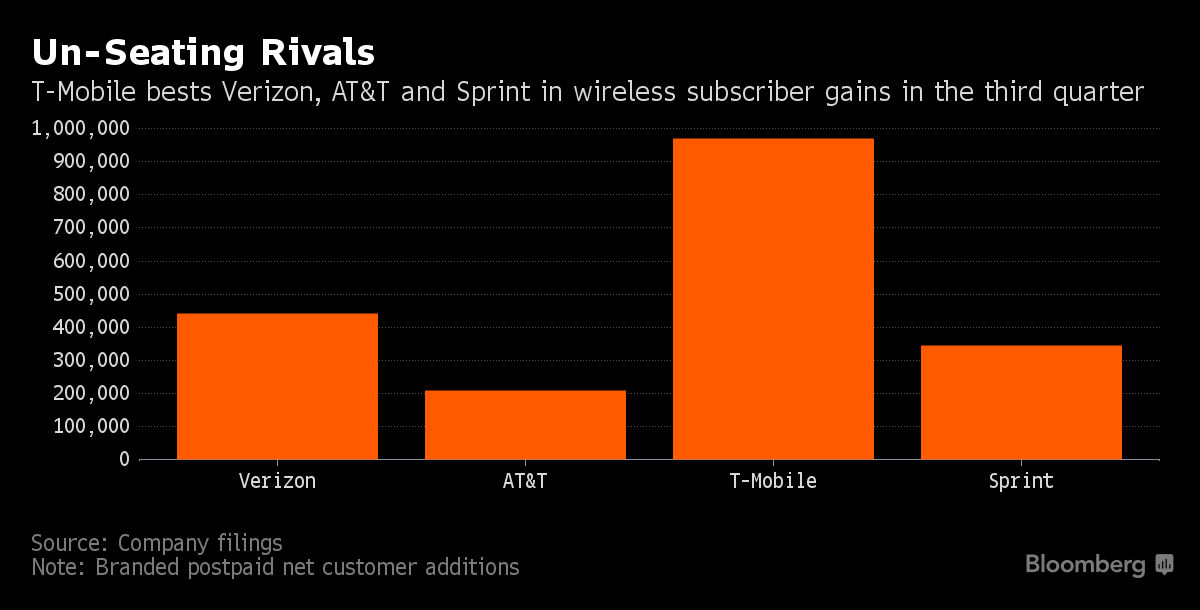

So how did all of this rule-breaking work out? In the first two years, T-Mobile added 22.5 million new customers. It’s now the fastest growing wireless company in America.

Below is a chart showing subscriber gains in the third quarter of 2016 — provided by Bloomberg.

But you might be saying, that’s all well and good for a massive brand with a massive budget, but what’s there to learn for my small to mid-sized bank?

Well, then you should keep reading.

Are you listening to your bank’s customers?

Whenever Thoma Thoma develops a large branding and/or marketing plan, our research includes surveys of current customers. We gauge their satisfaction with the client’s brand, their products/services, and their customer service. We also ask what they want and what they can’t get from our client that they can from a competitor. By listening to the customers, we plan strategic initiatives built to both delight current customers and attract new customers.

T-Mobile listened to their customers — or probably, unofficially, their screams. I imagine feedback included complaints about the daunting and confusing contract obligations, the myriad call and text-associated fees, and the outcry for more affordable upgrade options … the sort of complaints rampant among all Big Four customers. T-Mobile listened, and then did something about it. They became the only carrier offering a “no contract” cellular plan — keeping their current customers happy and attracting a wealth of new customers.

What can your bank offer that your customers are asking for? Have you started listening to your customers? What changes can you make even if they haven’t been done in the industry before? While we know you can’t give customers everything they want, what is one thing you can give that you aren’t providing now? By listening to your customers first, you can deploy those creative ideas with support from solid, data-backed research.

Are you living your bank’s brand?

Listening to your customers is an important step to take for improving your bank marketing, but you also have to turn your gaze inward. Is your bank living its brand — is it keeping its promises, is it speaking in a unique voice, does it have a distinctive design, and is it being communicated clearly to your target audiences? Most important, do you even know what your bank’s brand is?

Defining your brand and communicating it effectively is what makes your bank stand out. But living your brand starts at the top.

In 2012, John Legere became the CEO of T-Mobile USA — and became a living manifestation of the T-Mobile brand. Do a Google Image search of John Legere and your browser window will be flooded with the electric magenta of T-Mobile’s brand. See what we mean? Legere personifies that T-Mobile brand as a maverick CEO not afraid to break the rules (though not without some controversy). That same fervor for the T-Mobile brand trickles down into the company, into the stores and into the loyal customer base. Banks need leaders who not only know their brands, but live their brands.

We’ve helped banks find their key differentiators and turn them into solid, high-performing brands. We’ve also worked with bank leaders to clearly understand their own brands and how to live them out. If you’re able to clearly define your own brand and express it in every facet of your business — from the bank teller’s greeting to the interface within your mobile app — then you can communicate it to your potential customers via bank marketing all the more effectively.

Is your bank marketing authentic?

Banks — particularly mid-sized to small banks — generally could use a little help when it comes to engaging their audiences online. It takes a great deal of patience, time and content to create a successful bank marketing campaign. But it also requires authenticity.

In an interview with Adweek back in 2014, T-Mobile’s then-CMO Mike Sievert said that one of their most critically important tactics for digital marketing was authenticity.

“When we talk about changes that we want to bring out for the customer,” he said, “it’s not a bunch of corporate rhetoric.”

They stay consistent and true to their brand voice and style in all of their content. And, if you take a look at their Facebook page, you’ll notice they are quick to answer poor feedback and questions. Legere himself often engages with followers, living out the brand’s hyper-personal approach to customer service.

Being authentic involves knowing your brand and communicating that brand — not trying to be like your competitors. T-Mobile stands out precisely because it’s not like AT&T and Verizon, capable of catering to their customers’ wants and needs, eager to try new and un-tested initiatives, even if it means going against the currents of their industry.

We can help.

We know banks and we know bank marketing. We know the obstacles you face when it comes to budgets, compliance, location and competition. We’ve worked with several bank and financial institutions, helping them in everything from branding to advertising to digital marketing to customer experience.

If you’re interested, give us a call or send us an email. Let us show you how we can help your bank build a successful brand and attract new customers.